Download the ComplaintHub App" />

Download the ComplaintHub App" />

Didn't find any solution? Ask in Complaint Hub Citizen Community, we will help you.

CIBIL, or the Credit Information Bureau (India) Limited, now known as TransUnion CIBIL, is India’s first Credit Information Company (CIC). It maintains records of an individual’s payments for loans and credit cards. These records are submitted to CIBIL by banks and other lenders every month, and this information is then used to create Credit Information Reports (CIR) and credit scores.

CIBIL’s services are crucial for financial institutions as they assess the creditworthiness of potential borrowers based on the CIR and credit score provided by CIBIL. A higher credit score suggests good credit behaviour and responsible repayment patterns, making it easier for individuals to obtain loans and credit cards.

| Notice - Be alert! Don't share the financial or banking details and don't share OTP to customer care executive. Protect yourself from Frauds and Scams . Report to Cyber Crime Bureau or Call 1930 as soon as possible to protect your earnings and others. |

Some common issues that consumers may encounter with their CIBIL reports include:

Customers can resolve these CIBIL report problems by filing a complaint with TransUnion CIBIL. Follow the below steps for faster resolution of your dispute.

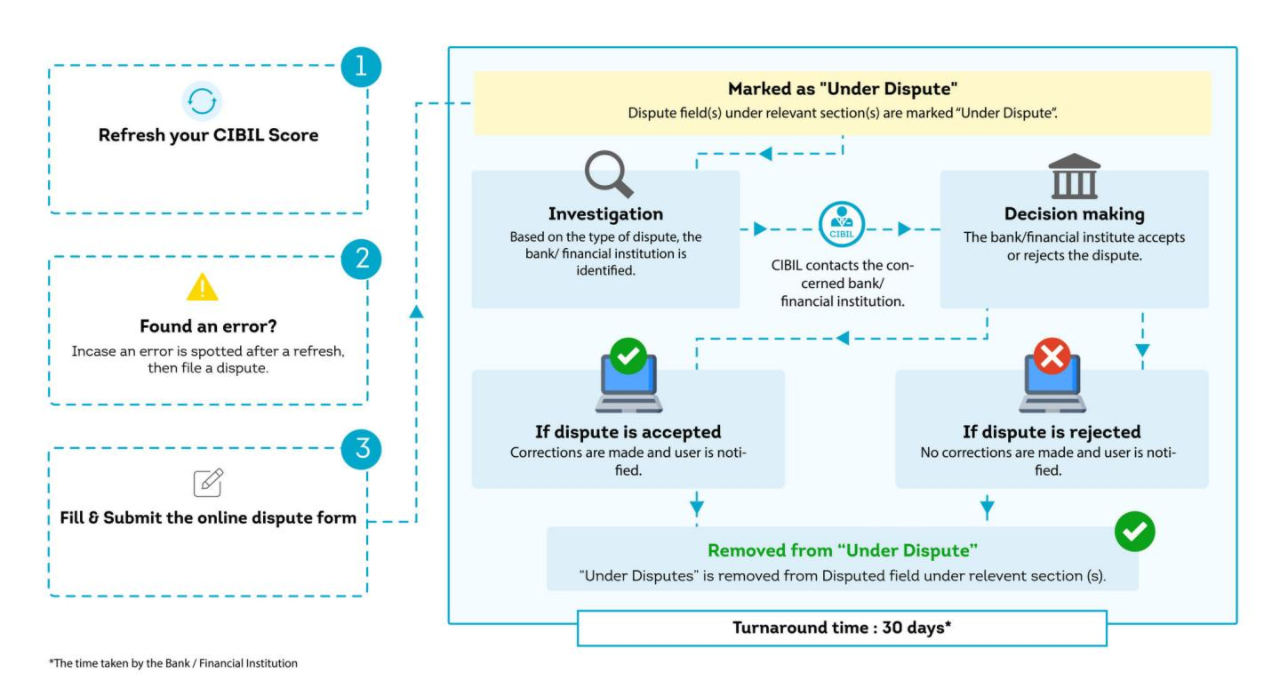

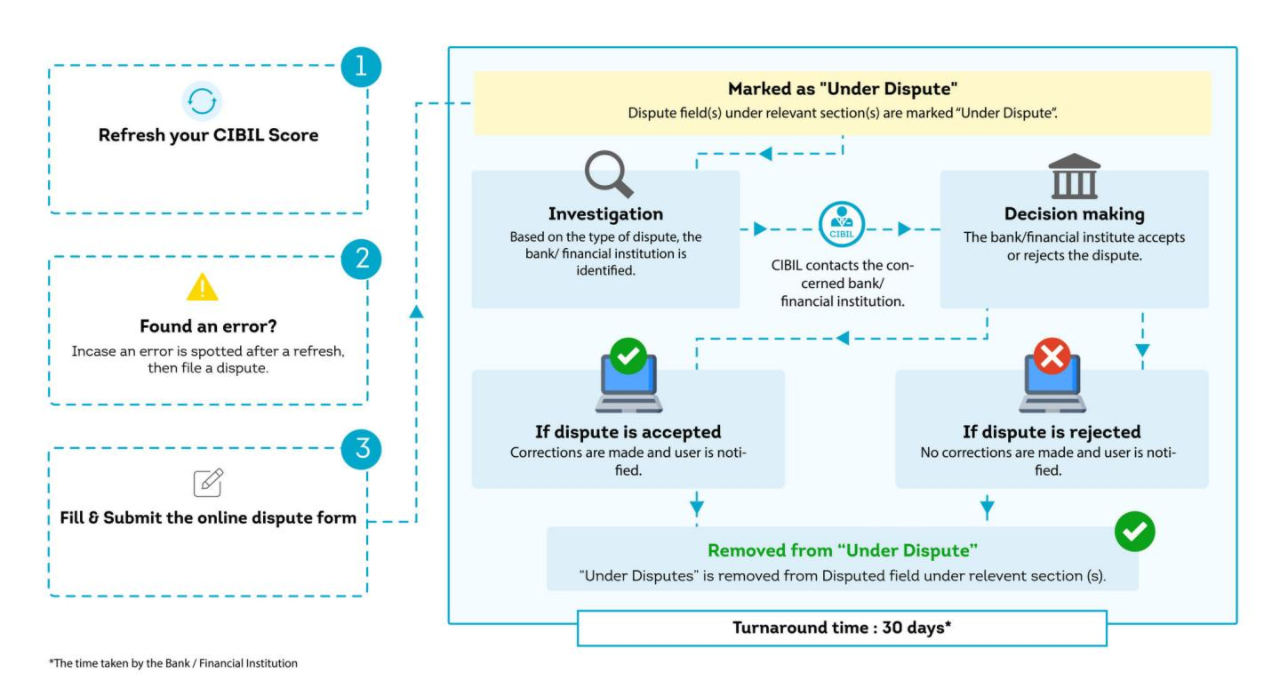

If you find inaccuracies in your CIBIL report, you can initiate a dispute resolution process to have them corrected. Here’s a step-by-step guide:

Before submitting a dispute, log in to the CIBIL portal and obtain your latest CIBIL report and credit score. Analyze it carefully for potential discrepancies. Further, you can:

For an online dispute resolution:

For offline submission, download or obtain the CIBIL dispute form. Complete it with accurate details and attach supporting documents. Mail it to CIBIL’s registered office (provided below).

During the grievance resolution process, the case will be escalated to the relevant bank or financial institution to verify the reported information. Further,

You can check the status of your dispute by logging into your myCIBIL portal. The final resolution may include:

For consumer support, use the below communication details of CIBIL:

If you’re unsatisfied with the resolution, you can escalate the matter to the appointed grievance officer by the CIBIL Escalation Desk, where you can submit an online grievance form. In your grievance form, quote your Service Request Number (SRN) obtained during the initial dispute.

Further, you can use the CIBIL Escalation Desk online form OR write a formal letter or email at nodalofficer@transunion.com to the Nodal Officer of CIBIL’s office. In your letter or email, you may provide your SRN, the Grievance ID of the previous case, and reasons for further escalation.

For any unresolved issues within 30 days or further escalation, you can file a complaint to the Banking Ombudsman under the Reserve Bank of India’s Integrated Ombudsman Scheme.

Remember to provide accurate and complete information when raising a dispute to ensure a smooth resolution process. Keep a record of your dispute reference numbers and correspondence for future reference.

Reference:

First published on:

Mar 1, 2024Complaint Hub has verified all the information on the post. If you have not found any solution, or information related to your issue, or want guidance to get redressal of any unique problem/complaint then you can connect with us without any hesitation.

You can message us directly from our Contact Us page or mail us at SUPPORT - help.complainthub@gmail.com. We will respond to you with the procedure and guidance for your issues to get a faster resolution.

Read the Terms and Conditions to use the information for any commercial or profit purpose ( Don't violate the Terms of Use ). All the information is provided for self-help and guidance to know the rights of the common people.

Dear TransUnion CIBIL Team, Greetings from Careers N' Options !! Good day to you!! I am writing to you with utmost urgency and seriousness concerning the repeated lack of response to our previous communications regarding the discrepancies in our CIBIL report. Despite multiple attempts to reach out via email and through couriered letters to your official address, we have yet to receive any acknowledgment or resolution from your end. This continuous neglect is causing significant distress and mental harassment, and it is imperative that we receive an immediate and satisfactory explanation regarding the inaccuracies leading to our unexpectedly low credit score. We demand a detailed justification and prompt rectification of our CIBIL report. We also require a knowledgeable representative to contact us and thoroughly explain the factors contributing to the current score. Kindly treat this as a final notice. Should we fail to receive an appropriate response and resolution within 10 business days from the date of this email, we will have no alternative but to initiate legal proceedings against TransUnion CIBIL for the undue stress and inconvenience caused. This email serves as a formal warning, and we urge you to address this matter with the seriousness it deserves to avoid further escalation. We expect your immediate attention to this critical issue.